It’s that time again when I take my best shot at sharing LMS and learning systems predictions. What should you expect for 2023? In short, I say we should all buckle up and get ready for the market’s wild ride to continue!

Learning Systems Market Snapshot

Throughout the past year, this space saw impressive momentum. As an industry analyst, I documented significant investment, innovation, and growth in every commercial learning use case category.

At the same time, the overall landscape has been expanding worldwide. In fact, I estimate that learning systems vendors are on track to generate more than $35 billion in revenue during 2023!

Despite increasing economic uncertainty, the industry’s growth trajectory should continue unabated. Learning systems providers are driving measurable value and innovation on all fronts – technology, functionality, integration capabilities, and services, as well as solutions designed for specific use cases and industries.

My Information Sources

Throughout 2022, I invested considerable time evaluating more than 150 vendors during the Talented Learning Systems Awards process. Then I dug even deeper into the 40 winning solutions to research and develop our new 2023 Commercial Learning Systems Market Report. Additionally, as a learning systems selection consultant, I helped dozens of buyers find the best solution for their needs last year.

Let me assure you, life on the front lines of learning systems buying and selling is dynamic, exciting, and revealing. And I’m more convinced than ever that this industry is headed in the right direction! Exactly what direction? Keep reading for a peek into the future…

Top LMS and Learning Systems Predictions for 2023

1. Employee-Focused LMS Demand Decreases in North America

More than 40 years ago, the first learning management system was introduced to corporate America. Now, nearly every organization with at least a few hundred employees has an employee LMS in place. So I wasn’t surprised when only 58% of our 2022 Learning Systems Award winners told us employee learning is one of their 3 most popular use cases.

LMS buyers typically upgrade only when major issues arise. For example, they may hit a functionality or scalability wall, or they’re fed up with horrible customer service. A change may also be necessary when expanding learning programs to external audiences, or when a merger/acquisition involves the company or its LMS vendor.

If an organization has a stable, cloud-based employee LMS with satisfactory functionality and reasonable customer service, there’s little reason to replace it. And hundreds of stable, cloud-based employee LMSs provide satisfactory functionality and reasonable customer service.

Given today’s saturated North American employee LMS market, I predict many vendors will choose one or more next steps:

- Improve learner experience, features, and services

- Expand rapidly into the extended enterprise space

- Enhance their offering through a merger/acquisition strategy

Those who do nothing risk becoming irrelevant.

2. Extended Enterprise Category Leads Market Expansion

North American and worldwide market growth are being driven by extended enterprise needs. In fact, 90% of our 2022 Learning Systems Award winners say extended enterprise learning is among their top 3 use cases. This means competition and innovation are fierce.

Most organizations have an employee LMS, but many are still discovering how to achieve a measurable competitive advantage by training external audiences. Many others with existing external LMS solutions are outgrowing these systems or are actively considering an investment in a single platform designed to support both internal and external audiences.

Other analysts may claim that organizational learning culture drives growth. But buying decisions are always about measurable results. And because it’s relatively easy to demonstrate the business impact of customer or partner training, I predict these programs will continue to fuel most of the industry’s growth.

3. Global Market Ignites

Historically, the North American LMS market led the rest of the world by several years. But widespread high-speed bandwidth, cloud computing, and other enabling technologies have leveled the playing field. As a result, learning systems demand is surging around the globe.

Once focused solely on employees, North American learning systems have evolved to support external audiences. But the rest of the world no longer faces the same mental hurdle and is adopting employee/external solutions from the beginning.

Expect to see competition surge from vendors based in other locations. To counter this threat, North American vendors can’t blindly apply domestic product strategies and sales models in other regions. Cultural and language differences, regulatory constraints, the need for access to local services, and the sensitive nature of learning itself mean global expansion won’t be a straightforward process.

I predict North American learning systems vendors will step up and partner their way into other geographic regions. Otherwise, they’ll lose these new market development opportunities to innovative and high-touch local vendors.

Do you want more information and analysis on the top 40 learning systems in the world? Buy our 2023 Corporate Learning Systems Market Update report – now available through the 2nd half of this year at a 50% discount!

4. Industry Consolidation Accelerates

According to our most recent count, more than 1000 learning systems of various types are available commercially. That’s really too many.

The market has been expanding for 15 years, thanks to ongoing technology innovation that pushed new boundaries, as well as creative ways of packaging and positioning solutions for specific market segments. However, we’ve seen consolidation in recent years.

I predict the pendulum will continue to swing toward more consolidation in 2023. Why? Investors have caught wind of our industry. Each week, I field dozens of inbound requests for intelligence about the LMS market and vendors of interest. Also, more purchasing organizations are pulling back on technology investments as they navigate economic headwinds. As a result, demand for new and upgraded learning systems is likely to hit some speedbumps.

This means vendor consolidation is inevitable. While this kind of adjustment can disrupt near-term industry dynamics, ultimately, it can be beneficial for customers.

5. Death of the Standalone LXP

Not long ago, the learning experience platform (LXP) was all the rage. But the standalone LXP era is rapidly coming to an end. It was certainly a brilliant invention that caught the LMS industry off guard. And it was a much-needed wake-up call about the limits of formal instructional content and the value of on-demand access to learning in all its forms. But now the cat is out of the bag.

For vendors, a learner-focused digital experience has become table stakes. This means proving the ROI of an incremental LXP solution is more difficult to justify every day.

We’re already seeing signs of this shift. Less than 10% of the 2022 Talented Learning Systems Award entrees described themselves as “LXP only.” And big names are adjusting. Cornerstone acquired EdCast last year. And Degreed will be lucky if it is acquired before it’s too late to sell at a premium.

6. All-Purpose LMS Platforms Narrow the Gap

For 10 years, I’ve watched the war rage among learning systems specialists and all-purpose platforms. As the name implies, specialists focus on only one or two use cases or industries where they can provide a superior solution. In contrast, all-purpose platforms support employees, as well as various external audiences such as customers and channel partners.

All-purpose LMS vendors typically offer more configurable functionality, but they bring less domain experience to the table. On the other hand, specialists tend to provide deeper use-case-specific insight and related professional services. However, the gap between these two worlds is diminishing. This means specialist business models are increasingly at risk.

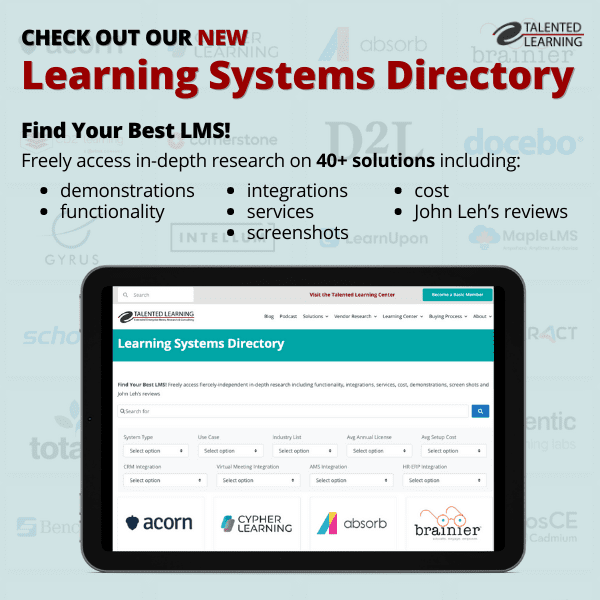

That’s why I predict the eventual demise of specialty providers, unless they find new ways to further differentiate their offerings and demonstrate greater business value. (To learn more about the top 20 vendors in both all-purpose and specialist categories, check out our growing Learning Systems Directory and our 2023 Commercial Learning Systems Market Report.)

7. Customer Education Platforms Acquire/Merge with CRM or Customer Success Platforms

One way specialty learning systems differentiate themselves is by pivoting in a completely different direction. While the employee LMS market is saturated, the customer education market is healthy and is poised for exponential growth. Educating customers is big business, and companies in every industry want to improve customer success and retention rates. Educating prospects and customers more quickly and effectively is a measurable way to achieve those goals.

I predict customer education specialist systems will begin merging with CRM platforms. And here’s the kicker: This new, unique solution category will be impossible for all-purpose LMS vendors to overtake. (Want to discuss potential acquisition targets with me? Schedule a 1-hour phone consultation.)

Do you want more information and analysis on the top 40 learning systems in the world? Buy our 2023 Corporate Learning Systems Market Update report – now available through the 2nd half of this year at a 50% discount!

8. The “Headless” LMS Gains Mindshare

Once upon a time, the scary story of Ichabod Crane made the “headless horseman” famous. But headless software is anything but scary. Actually, this technology lets organizations write their own custom front-end learning experience with powerful APIs that automatically pull and push data to and from an LMS and other platforms in the ecosystem.

Why is this a game-changer? Because LMS vendors can’t envision and enable every scenario, out of the box. Also, organizations appreciate flexibility. They don’t want to limit their learner experience to whatever a vendor may choose.

I predict headless LMS adoption will take hold in the coming year as costs decrease and capabilities improve. Who will lead the way with this capability? For starters, Absorb LMS, BlueSky eLearn, LearnUpon, Docebo, Thought Industries, and Web Courseworks.

9. Services Are Resurrected

As the learning systems world matures and more organizations move beyond their first LMS, the need for strong professional services is increasingly essential. Purchasing organizations are looking for expertise across multiple disciplines. In-demand skills include: project management, workflow consulting, content and data migration, systems rollout and change management, learning analytics and reporting, content development, mobile app creation, marketing services, training administration, and more.

I predict vendors with a strong professional services portfolio will continue to win opportunities by positioning themselves as hands-on business and technology partners.

Vendors to watch include Administrate, BlueSky eLearn, Brainier, Cadmium, CD2 Learning, Crowd Wisdom, D2L, Docebo, Growth Engineering, NetExam, Schoox, Skilljar, and many more.

10. What’s Hot in 2023?

If you want to stay ahead of top trends in the learning systems landscape this year, pay close attention to these keyword phrases wherever you go:

Adaptive learning, artificial intelligence and generative AI (ChatGPT anyone?), certificates and certifications, cohorts, content-as-a-business, content syndication, customer education, headless LMS, intra-LMS content authoring, learner experience, LTI (learning tools interoperability), mobile learning apps, no-code integrations, and professional services, as well as skills and competencies.

But perhaps above all, look for more action on the analytics and measurement front. This is essential if you want to prove and improve learning impact.

11. What’s Not-So-Hot?

What will continue to lose traction among learning systems in 2023? Here’s what’s fading from my radar:

Authoring tools, clicking, employee-only LMSs, formal courses, LinkedIn newsletter invitations, manual LMS administration, standalone LXP, poor customer service, SCORM 2004, tech-heavy integration and reporting, VR, and xAPI, as well as sales pressure and the phrase “We can do whatever you need.”

…also here’s one extra prediction that hits close to home…

12. The 2023 Learning Systems Market Report Takes the Learning World by Storm

I’m probably biased because I spent the last six months researching and writing this report, but I think the learning systems world will take a keen interest in our Commercial Learning Systems Market Report. That’s because this in-depth analysis is practical, informed, and fiercely-independent.

We’ve designed it specifically for learning systems buyers, sellers, investors, and other learning professionals who value useful intelligence over marketing fluff. It is the only report that spotlights the five core commercial learning use cases through the lens of the world’s top 40 solutions.

Living the last 20 years in the learning systems buying and selling trenches has given me a unique perspective on many aspects of the learning systems landscape. And I’ve brought all of it to the table in this analysis. I invite you to learn more about how our report can help you gain the insight you need to succeed in the coming year.

That’s it for now. Exciting times are on the horizon for learning systems! Don’t you agree? Hang on – we’re just getting started. Thanks for reading!

Need Expert Help to Define Your LMS Integration Requirements?

Fill out the form below to schedule a free consultation call with me, John Leh, to discuss your LMS implementation and integration needs:

Share This Post

Related Posts

The Future of Customer Education: Customer Ed Nugget 16

Customer education is rapidly evolving as organizations embrace new strategies and tech. What does this mean for the future of customer education? See what experts say on this Customer Ed Nuggets episode

Education Strategy Mistakes to Avoid: Customer Ed Nugget 15

What does it take to deliver a successful customer education program? It starts with a solid education strategy. Learn how to avoid common pitfalls on this Customer Ed Nuggets episode

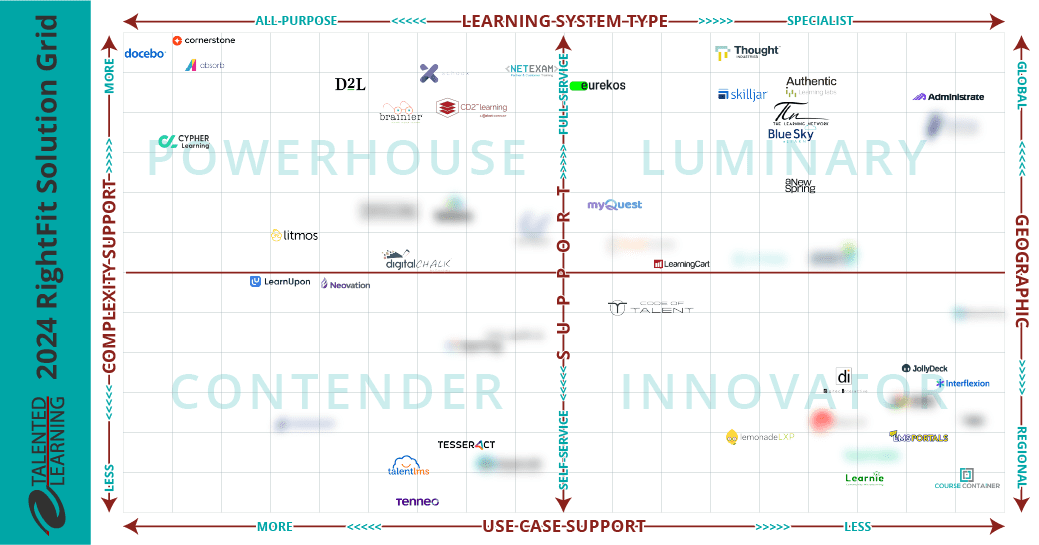

Which LMS is Best for You? New Shortlisting Tool for 2024

How can you find the best learning system for your business? Our LMS shortlisting tool can help. Learn about the 2024 RightFit Solution Grid. Free, reliable guidance based on our independent research

How to Build a Learning-Based Business: Executive Q&A Notes

Building and selling online courses may seem easy, but building a profitable learning-based business is far more complex. Find out what successful leaders say about running this kind of business

The Rewards of Community Building: Customer Ed Nugget 14

What role does community play in your customer relationships? Find out why community building is such a powerful force in customer education on this Customer Ed Nuggets episode

Benefits of Training Content Syndication: Customer Ed Nugget 13

If you educate customers online, why should you consider content syndication? Discover 10 compelling business benefits in this Customer Ed Nuggets episode

Top Marketing Skills to Master: Customer Ed Nugget 12

Successful customer education programs depend on professionals with expertise in multiple disciplines. Which marketing skills lead to the best results?

How to Measure and Improve Partner Training ROI

An educated channel is a successful channel. But how do you know if your educational programs are effective? Learn from an expert how to evaluate partner training ROI

Mistakes in Ongoing Customer Training: Customer Ed Nugget 11

Customer education doesn't stop with onboarding. It pays to invest in ongoing customer training. Learn which mistakes to avoid in this Customer Ed Nuggets episode

FOLLOW US ON SOCIAL