EDITOR’S NOTE: Because extended enterprise learning involves multiple disciplines, we sometimes ask other experts to share their insights. Today we feature advice from Ajay Pangarkar, CTDP, FCPA, FCMA and President of CentralKnowledge. Ajay is an award-winning blogger, author and LinkedIn online course instructor who helps learning practitioners develop the financial acumen they need to calculate LMS ROI and align training initiatives with key business objectives.

Why is LMS ROI Analysis Important?

If you’re responsible for organizational learning, you’re probably planning new or improved instructional programs for the coming year. To make this happen, you’re likely to need new hardware, software and various other resources. But how do you decide what to spend?

Many people would say, “If it’s in the budget, just buy it.” And this could work for insignificant or inexpensive items like training materials or related office supplies.

However, modern learning experiences usually require significant technology purchases. For example, you may need to invest in a learning management system (LMS), applications for certification tracking, ecommerce and collaboration, as well as content authoring tools.

Big-ticket items like these are considered capital investments. They must be pre-approved by business leaders and financial specialists who use standardized methods to justify technology purchases. Below, we’ll examine two key approaches:

- Cost-benefit and break-even analysis

- Net present value (NPV) analysis.

Two Ways to Evaluate LMS ROI

Method 1: Cost-Benefit/Break-Even Analysis

At first glance, results-oriented learning programs are considered a cost. But leaders will also consider them an investment – if you frame the benefits appropriately. Consider this simple scenario:

ABC Company sells productivity software for $200 per user. ABC just released a new version with additional features. The cost to produce this application is $120 per unit and the sales volume is 4000 units per year.

Mary is ABC’s president. She believes a new elearning course could help marketing and sales teams increase sales by at least 700 units in the first year without causing any work disruptions.

You expect this course to cost $60,000 – including equipment, technology, content development and design. In addition, ABC must account for $200,000 per year in existing learning-related fixed costs.

Before approving the course, Mary asks you to provide a financial assessment to prove that this endeavor makes business sense.

Should ABC Company Invest in a New Course?

Many training practitioners would say, “Yes, certainly it makes sense.” This conclusion is based on the assumption that an elearning investment of $60,000 will incrementally increase sales by $140,000 (700 units x $200 per unit), so ABC will gain $80,000.

But this is only part of the story for business leaders, because they also compare the difference between current and projected sales and costs.

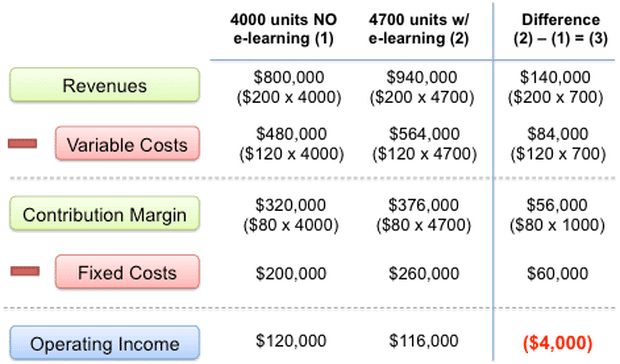

In this case, at the current sales level of 4000 units, ABC earns $120,000 in operating income (column 1 below). But after including the $60,000 new elearning fixed cost and expected sales increase (column 2 below), it’s clear that ABC would actually lose $4,000.

ABC Cost-Benefit Analysis By The Numbers

Because the new elearning course would decrease operating income to $116,000, Mary won’t support the decision to move forward.

At this point, many learning practitioners would sell their souls to convince Mary she should sign-off anyway, because training always makes sense. Well, I hate to burst your bubble, but learning doesn’t always make good business sense.

It’s true that by rejecting the elearning initiative, ABC won’t gain 700 units in additional sales. However, the company won’t incur the additional $60,000 in elearning fixed costs, either.

Worst-case, the current profit level will remain unchanged. Sales might even grow, given the new functionality available in ABC’s latest release.

What Could Change Mary’s Mind?

To win support for the elearning course, you could:

- Work with sales and marketing teams to increase sales by 50 units or

- Find a way to reduce elearning development costs by $4,000.

Either of these actions will create a “break-even” outcome. Of course, ideally, leaders aim higher than break-even. They’re looking for profitable outcomes.

In this case, profitability means increasing sales by more than 50 units and/or reducing costs by more than $4,000. As a learning professional, you don’t control sales performance. But you can control elearning costs.

Recommended Course of Action

To reduce the fixed cost of developing the new course, take time to review all of the elements – from related technology to content development.

Next, identify what’s absolutely essential to create and deploy the course. These are your “must-have” requirements. Others are only “nice-to-haves.”

Unless you can convince Mary that “nice-to-have” items will yield tangible business benefits, the budget won’t increase. And without an increased budget, you’ll need to let go of those non-essentials.

Method 2: Net Present Value (NPV) Analysis

I once worked with a major pharmaceutical company on a new prescription drug launch. Educating the sales team and the medical community about the appropriate use of this drug was vital.

Management expected a 15% ROI from this product and 15 years of revenue growth. Most of the internal costs – including training – were expected to occur during the first 3 years. The remaining costs were expected to level-off over the product’s lifecycle.

These inputs guided our learning investment decisions. Leaders call this “capital budgeting.” It’s based on a classic ROI concept called Net Present Value (NPV). NPV analysis considers the value of an activity’s so-called discounted cash flows over its lifespan, based upon an expected rate of return.

The Net Present Value Equation

In other words, NPV is the difference between a project’s present value for every year of cash inflows (typically from revenue or savings), and the present value for every year of cash outflows (usually expenses) that support the project.

When the present value of total cash inflows exceeds the present value of total cash outflows (PV Inflow > PV Outflow), NPV is positive. In this case, the investment should be approved.

In contrast, when the present value of total cash inflows is less than the present value of total cash outflows (PV Inflow < PV Outflow), NPV is negative. In this case, the investment should be rejected.

Should You Purchase This LMS?

For example, imagine you’re considering the purchase of an enterprise LMS to support employee skills development. This new LMS costs $80,000. Maintenance costs $5000 per year and the LMS will last 8 years.

The investment is expected to improve employee productivity in ways that increase cash inflow by $25,000 per year.

Your leaders expect a 15% ROI. But to inform their decision about this capital investment, they apply NPV analysis.

The immediate cash outflow for this LMS purchase is $80,000. And every year over an 8-year timeframe, improved employee productivity is expected to increase cash inflows by $25,000. During the same period, LMS maintenance will cost $5,000 per year.

This means that net annual cash inflow = $20,000 ($25,000 – $5000).

However, because this $20,000-per-year net cash inflow occurs over multiple years, the present value is actually different each year. (In other words, the $20,000 you’ll gain in Year 1 is worth more today than the $20,000 you’ll gain 8 years from now).

To determine each year’s current net cash inflow value, leaders apply an annual ROI “discounting” rate. In this example, it is 15% each year. This equalizes the yearly amounts.

In this example, NPV equals about $9,750. Because this result is a positive number, you should approve the LMS purchase.

What About The Drug Launch?

Let’s return to the pharmaceutical example. Leaders weren’t achieving the expected level of profitability over the product’s 15-year life.

Revenue forecasts were conservative, so increasing sales to reach the profit target wasn’t a realistic option. The only choice was to re-evaluate and reduce internal costs.

Leaders recognized the importance of training in supporting compliance and legal requirements. They asked the training team to identify ways to reduce costs and/or reallocate opportunities without degrading the impact of learning activities.

As a result, we reduced overall training costs by 10%. And along with cost reductions from other internal activities, the company exceeded profitability expectations.

Next Steps: Speaking the Language of Business Leaders

Ultimately, you’re not responsible for determining LMS ROI. The decision rests with your organization’s leaders and finance department. But here’s how you can inform those decisions.

For any major learning technology investment, be prepared to answer these questions:

- What is the initial cost?

- How long will this training asset last or be used?

- What are the expected operational costs?

- What savings or positive financial results will this technology contribute during its life?

You’ll also want to plan training programs with measurement in mind, right from the start. For more guidance about how to do that, I invite you to check out a LinkedIn Learning course I offer: Measuring Training Effectiveness.

Final Thoughts

This brief overview of cost-benefit and NPV analysis is intended only as an introduction to what’s involved in capital investment decisions.

It’s not necessary for learning practitioners to become experts at ROI evaluation. However, awareness of the process can improve your ability to secure funding and will give you a leg-up in consulting with decision-makers.

So, in the future, whenever you need to develop a proposal to win funding for significant learning technology resources, I encourage you to work with your finance team to build a robust business case. Even if you don’t receive purchase approval, your proposals will be better aligned with business objectives and your financial acumen will definitely impress your organization’s leaders.

EDITOR’S NOTE: This post has been adapted, with permission, from posts published at eLearning Industry.

Need Proven LMS Selection Guidance?

Looking for a learning platform that truly fits your organization’s needs? We’re here to help! Submit the form below to schedule a free preliminary consultation at your convenience.

Share This Post

Related Posts

The Important LMS Differences In Compliance, Continuing Ed and Selling CEUs

Individuals are ultimately responsible to know their own ongoing continuing education requirements, take the required training, maintain ongoing proof of completion and submit to appropriate accreditation body to maintain their license or certification.

Under the Hood of Complex CEU Management

With each incremental accrediting jurisdiction the problem compounds and becomes so complicated that many organizations can’t use a commercially available LMS to manage CEUs but rather are forced to cobble together spreadsheets, home-grown custom systems, specialized commercial CE trackers and manual processes to bridge the gap, connect the data and ensure compliance.

Intro to the Continuing Education Admin Nightmare

In the accounting industry, most accounting firms set up a National Association of State Boards of Accountancy (NASBA) license and grant continuing professional education (CPE) credit based on the NASBA standards, rather than maintain the complex CPE rules of each state

LinkedIn Learning and Workforce Development: Connecting Skills and Jobs

The emphasis on the bridging “Skills Gap” has put new life into workforce development programs globally -- and no matter what size of a population you’re targeting, in a modern world, an online platform and delivery option has to be considered – gone are the days of just meeting with a counselor to develop a plan and then sit in a classroom.

Buying a Learning System? 110+ LMS Acronyms You Should Know

I concluded that it will take too long to teach 700+ LMS vendors the new anti-acronym trick and the easiest path would be to create a living, one-sentence, non-techie dictionary of LMS acronyms for learning systems buyers.

LMS Review: Brightwave Tessello

Brightwave, with its innovative xAPI driven tessello learning system, focuses on managing the real-life balance of learning by doing (experiential), learning from others (social) and formal learning (old school).

LinkedIn Outfoxes the Continuing Education World With Lynda.com Acquisition

By collecting skill endorsements and recommendations from your network and posting content, comments, presentations, awards, articles, certifications and other relevant data, you create a historical profile of credibility that other users recognize and value – and more so every day with a growing base of more than 610 million LinkedIn users in more than 200 countries.

15 Tips to Up Your Demo Game and Win Rate: For LMS Vendors

Many sales reps and solution architects take the demo step lightly because they have done the same presentation so many times that they think they have seen it all and know it all; as a result, they prep too little, make a vanilla impact with the customer and get lost in the herd of possible LMS solutions.

LMS Review: RISC VTA

This type of approach is consistent throughout the product and provides a lot of flexibility because you can approach an administrative problem from many angles to get, set and report on training the way you need it.

FOLLOW US ON SOCIAL