There are many ways to buy a learning management system. In fact, if you look closely at the hundreds of vendors in today’s learning solutions landscape, you’ll find an increasingly diverse number of LMS license models. These variations are intended to help buyers meet their unique business objectives. But with so many choices, it’s easy to become confused.

My goal in this article is to introduce you to the most common LMS license models, so you can make better-informed purchasing decisions.

Defining Key Terms

What are LMS license models? In short, they’re the way learning software vendors measure the use of their solutions and charge customers for access. This is different from cost. Cost is the relative expense a buyer incurs when using a solution within a selected license model.

The way a vendor licenses its learning solution is often a significant competitive differentiator. And for buyers, it is a critical go/no-go factor in purchasing decisions.

Which learning system is best for you? Check the 2024 RightFit Solution Grid, based on our team’s independent research! Learn more and get your free copy!

Historical Perspective

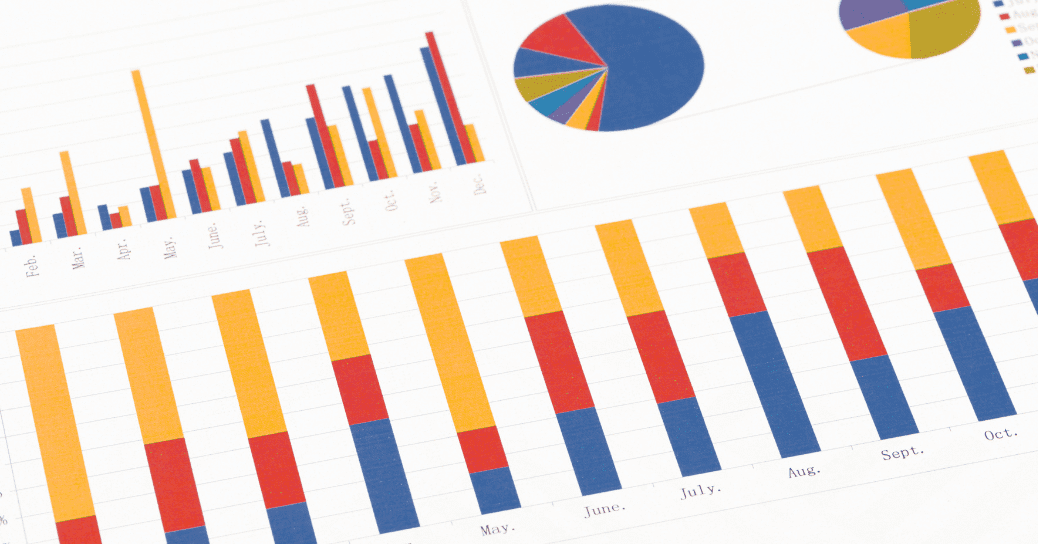

For many years, LMS vendors held all the cards. However, that’s no longer the case. In fact, during our 2022 Learning Systems Awards evaluation process, we surveyed more than 100 vendors about the LMS license models they offer. Interestingly, their responses have shifted dramatically, compared with our original LMS industry analysis nine years ago.

Consider this: In 2014, less than 10% of vendors offered a license based on active monthly users, while 50% offered a perpetual license. But over the years, that ratio flipped. Now, 67% of our 2022 “Top 40” LMS award winners offer a monthly license model based on actual usage, while only 6% still offer a perpetual license with annual maintenance fees.

Why has the landscape changed so much? Several factors are at work:

- Over the past decade, cloud computing has emerged as a standard for B2B software infrastructure.

- Also, monthly licensing has become common in most software categories, so organizations expect it from LMS vendors, as well.

This change has been good for our industry. For years, learning system vendors were maligned for charging steep upfront license fees, followed by terrible service. But the emergence of usage-based pricing has helped LMS vendors evolve into customer-focused businesses. They realize it’s essential to deliver measurable value every single day, or else they’ll risk painful, costly customer churn.

Common Pitfall: LMS License Misalignment

With so many licensing options available, it’s not uncommon to see a disconnect between an organization’s needs and its software license. This kind of license misalignment is a great way to start hating your learning system vendor, even if you appreciate your LMS functionality. In fact, as a long-time learning systems selection consultant, I find that license misalignment is the main reason why clients hire me to help them switch LMS vendors.

To diagnose LMS license misalignment, look for these symptoms:

- You are paying for learners who are not engaged with the system

- Admins are deactivating learner accounts just to stay below a usage cap

- You’re facing cash flow issues because you’re paying your vendor a huge annual fee

- The total cost of ownership doesn’t scale proportionately as your needs change

Regardless of the symptoms, the core issues with license misalignment are the same. It’s about unnecessary (and often unfair) costs, combined with more irritation than software buyers want or deserve.

Want a better way to manage the business of learning? Find vendor profiles, reviews, case studies and more in our free Learning Systems Directory…

The Most Popular LMS License Models

Our 2022 “Top 40” learning systems analysis identified the following types of licenses, as well as the percentage of vendors offering each model. To serve a broader range of buyers more flexibly, many vendors now offer more than one way to license their solution:

1) Monthly Active Users – 67%

The most popular LMS license approach accommodates an unlimited number of learner records in the database. However, charges are based on a pre-determined rate for the total number of users who log in, purchase, or register for at least one course during a given month.

2) Annual Active Users – 67%

For years, this has been a common approach among cloud-based software providers. Similar to the monthly active user model, an unlimited number of learner records are accepted in the database. However, charges are based on a pre-determined rate for users that log in, purchase or register for at least one course during a given annual period.

(NOTE: Although our research found that the same percentage of vendors support both annual and monthly usage models, the vendors in each group are different.)

3) Unlimited Use – 36%

This is also known as an enterprise license. At this level, vendors stop counting usage. This approach was more common when perpetual licensing was more popular. But now that active user options have become widely accepted, this option is increasingly rare.

4) Named User – 21%

This is the least flexible plan. It is typically reserved for employee-focused solutions, where organizations must purchase an active LMS “seat” for each employee, regardless of whether a “named user” ever logs in or uses the LMS.

5) Revenue Share – 15%

Some smaller LMS specialists serve training businesses and subject matter experts through revenue-sharing partnerships. In other words, there are no licensing or implementation costs. Instead, these vendors take a portion of a content creator’s course revenue or profit as compensation. This is a risky approach for vendors because it depends directly on buyers’ business success. And for successful content creators, it can become cost-prohibitive as sales grow.

6) Location-Based – 10%

This is a variation of the revenue share model, used primarily in the franchising industry. When a new independent or company-owned franchise location opens, the LMS provider charges a pre-negotiated price for that location.

7) Perpetual – 5.1%

As noted previously, this vendor-friendly licensing approach has fallen out of favor. Buyers purchase the software license one time, upfront. Then they must invest in an annual maintenance plan for access to ongoing upgrades and support.

8) Training Volume – 5%

Very few vendors charge based on the number of courses or amount of content a buyer manages in the LMS. This is risky because it’s difficult to predict and measure for buyers and sellers, alike.

9) Open Source – 3%

Open source is a “free” license that a buying organization must deploy and maintain on its own servers (or through a hosting partner).

Conclusion

Smart training professionals are aware that LMS license models have been changing, along with broader software trends. As a result, many have been rethinking their licensing approach and are shifting to solutions that align with their use case and business requirements.

If you’re in a situation where your license model is misaligned, you’re likely to be overspending on your learning platform. I recommend following the path of successful learning leaders. Start looking at how you can switch your system, save money and eliminate headaches. Good luck and thanks for reading!

Is Your LMS License Misaligned?

You don’t deserve it. And your vendor doesn’t deserve you. LMS license misalignment is a disease I cure every single day. Fill out the form below to schedule a free preliminary consultation call.

Share This Post

Related Posts

Measuring Customer Training ROI: Which Metrics Matter?

How can companies prove the value of customer education? It starts by understanding which metrics are best for measuring customer training ROI...

Top Customer Education Marketing Tips: Customer Ed Nugget 29

Thoughtful promotion can make a customer learning program shine. But which customer education marketing moves matter most? Find out on this mini-podcast...

2025 LMS Awards: Celebrating the Best Enterprise Learning Systems

Which enterprise learning systems are the best? Find out about the top solutions, as independent learning tech analyst John Leh reveals winners of our 2025 LMS Awards...

4 Crucial Marketing Mistakes to Avoid: Customer Ed Nugget 28

Customer education success depends on strong marketing strategies and tactics. How can you avoid marketing mistakes that undermine your efforts? Find out on this mini-podcast...

Workday Buys Sana: A Second Chance for Enterprise Learning?

Workday just announced plans to acquire Sana Labs. What does this mean for the future of enterprise learning? Our Lead Analyst, John Leh, weighs in...

Selling Enterprise Software? Choose Pilot Programs for the Win

Selling B2B software is a highly complex process. How can both buyers and sellers succeed? Focus on the enterprise buying motion, and pilot programs, in particular. Follow these expert tips...

Compliance Training: Moving From Obligation to Opportunity

How can you transform compliance training from a checkbox exercise to a powerful culture-building engine? Try these proven strategies and tactics...

AI in Training: What Pros and Cons Should You Consider?

AI in training is a powerful double-edged sword. How can you make the most of AI as an asset without being blindsided by liabilities?

LMS Vendors: Enter the Talented Learning Awards 2025

Soon, we'll be celebrating the world's best enterprise learning systems for 2025. So, if you're an LMS vendor, it's time to enter the Talented Learning Awards. See how to participate...

FOLLOW US ON SOCIAL