I love acquisitions. They shake things up and restack the competitive deck giving new competitors a chance. In only a few short days, my reaction to Skillsoft acquiring SumTotal Systems has shifted from “Wow!” to “Hmmm” to “Eureka” to “Yeah!”. Here’s how my thoughts progressed through each stage:

Wow

My very first thought was I can’t believe Vista Equity Partners was able to unload SumTotal Systems. Vista is a private equity firm that purchases flailing software companies, implements their significant best practices, turns them around and sells them and that of course was the plan with SumTotal. However, Vista was never in the LMS and talent marketplace before and they struggled mightily for years until they learned that we’re an odd and very educated breed of buyers that prefer experienced pros to college kids.

They also spent a fortune buying and integrating complementary talent management product companies to create an end-to-end talent management suite to compete with SAP and Oracle. They paid a high price but now SumTotal has a modern, powerful, competitive, integrated suite of products. They also have hundreds maybe thousands of customers on legacy products that they are still supporting. Somewhat of a nightmare scenario for Skillsoft to inherit in my opinion.

Vista should be congratulated for selling SumTotal at any price. They probably feel very similar to how my wife and I felt recently when we sold the last of our student rental properties at a price significantly below what we wanted. Elated.

Hmmm

After the wow wore off the hmmm set it. Why would Skillsoft want to enter the highly competitive talent management software business? What does a training content company know about running an integrated talent management company? What possible synergies could there be that outweigh the baggage of SumTotal?

Perhaps there is enough meat on the bone to leverage the huge Skillsoft salesforce and drive content to all 3000+ SumTotal clients. However, I have to think that many of those clients already use Skillsoft content as SumTotal has been a Skillsoft channel partner for over 10 years. Or perhaps they believe they can drive SumTotal solutions to their 6000+ content customers via their content salespeople. But as Vista could tell them selling enterprise solutions with the wrong type of salespeople is a Herculean feat.

What about all the friction this will create between Skillsoft and its channel partners consisting of now LMS and TM competitors? LMS vendors were never threatened by Skillsoft’s Skillport LMS but now with the SumTotal LMS, it’s a different story. Incumbent LMS vendors won’t take kindly to the selling in their backyard by a partner. Many TM and LMS providers will have to explore new partnerships with other content vendors. Open Sesame, anyone?

Eureka

Then this hit me when reviewing SumTotal’s website. Maybe it’s a leapfrog move by Skillsoft to become the dominant player in Talent Management by unseating SAP, Oracle and Workday from the inside.

SumTotal has built has a huge TM platform in the cloud with at least 15 interconnected components from recruiting, compensation, LMS, performance, succession and even time and expense management. SumTotal’s unique competitive advantage is that a buying organization can easily implement any one of the 15 modules and use it alongside their other existing Talent Management components without replacing everything. SumTotal even provides reporting that could include data from the non-SumTotal components.

So imagine this…

Skillsoft’s customers are also Oracle, SAP and Workday customers. What if Skillsoft gives the SumTotal LMS to their clients for free or almost free? Skillsoft clients could switch out their inferior Skillport LMS with the superior SumTotal LMS and presto Skillsoft has a beachhead to sell the other 14 products over time to every one of their 6000+ customers right under the noses of the big HR and TM providers. Lots of meat on that bone.

Yeah!

Can Skillsoft pull it off and disrupt the market? Maybe. I’d give it a 50/50 chance based on all the failures of the other big mergers and acquisitions in our industry. The new company will have a ton of moving pieces to manage and grow and many of the pieces are foreign to them. If they make it, they could really be tough to beat for a long time.

While we find out, the LMS industry is going to enjoy the carnage like it was 2011-2012. There are going to be many SumTotal customers left behind, commitments will be blown and confusion will reign. Account managers and support teams will change as SumTotal is integrated into the new company. Employees will leave the organization voluntarily and involuntarily, customer relationships will suffer and the comparative shopping will begin.

If I was a Skillport LMS customer, I’d use this opportunity to try and lock in a low cost, longer-term contract with the much better SumTotal LMS. If I was a SumTotal customer, I’d be making sure I wasn’t forgotten. Either way, customers are going to need advice.

Gotta love acquisitions. Thanks for reading!

Learn More: Webinar Replay

The Economics of LMS Replacement

Stuck with a learning management system that no longer meets your needs? Do you pay for annual maintenance and hosting, but haven’t upgraded in years, and rarely use tech support? Want to expand your learning program reach to customers, channel partners or others, but can’t afford the incremental licenses? Ready to move up to a new solution, but unsure about what it should cost? If any of these scenarios are familiar, this webinar is for you.

Join Talented Learning lead analyst and CEO, John Leh, as he shows you how to take charge of the LMS replacement process and lead your organization into the modern learning age. You’ll get insider perspectives and research-backed insights to help you overcome internal inertia, speak the business language of executives and get approval to replace your LMS. In this fast paced, information packed session, you will learn how to:

– Analyze what you’re currently spending (and why)

– Define what you need in a new LMS

– Outline the best license model for your intended use

– Develop realistic budget expectations

– Create a business case your stakeholders can support

– Find vendor intelligence you can trust

Replay this on-demand webinar now!

Need Proven LMS Selection Guidance?

Looking for a learning platform that truly fits your organization’s needs? We’re here to help! Submit the form below to schedule a free preliminary consultation at your convenience.

Share This Post

Related Posts

The Future of Customer Education: Customer Ed Nugget 16

Customer education is rapidly evolving as organizations embrace new strategies and tech. What does this mean for the future of customer education? See what experts say on this Customer Ed Nuggets episode

Education Strategy Mistakes to Avoid: Customer Ed Nugget 15

What does it take to deliver a successful customer education program? It starts with a solid education strategy. Learn how to avoid common pitfalls on this Customer Ed Nuggets episode

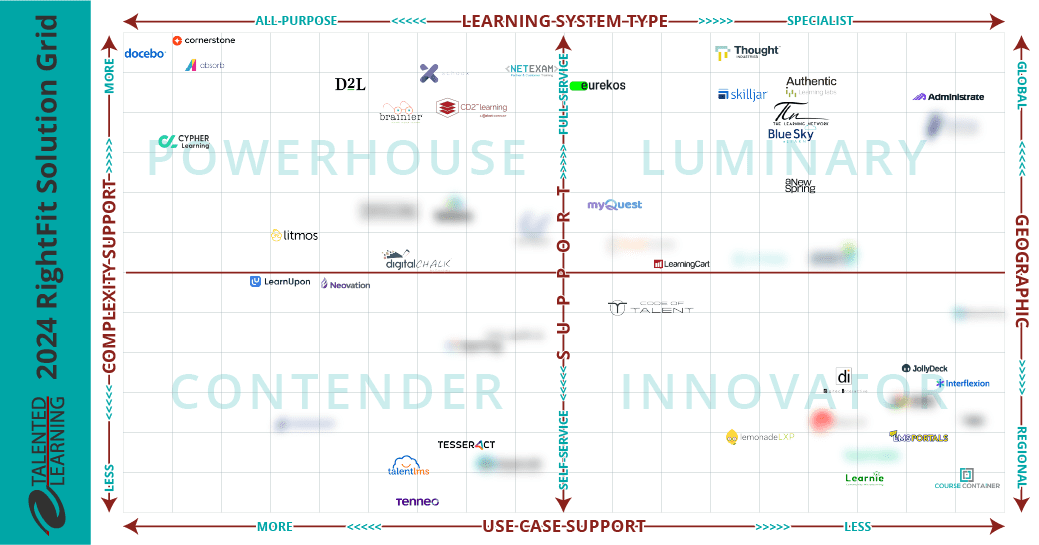

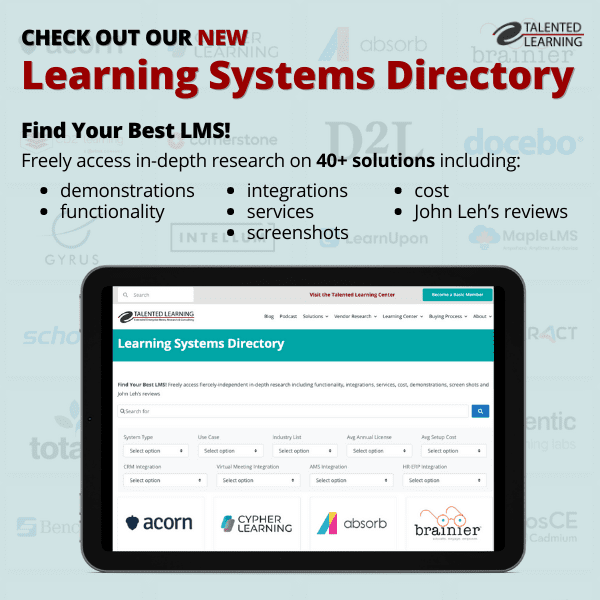

Which LMS is Best for You? New Shortlisting Tool for 2024

How can you find the best learning system for your business? Our LMS shortlisting tool can help. Learn about the 2024 RightFit Solution Grid. Free, reliable guidance based on our independent research

How to Build a Learning-Based Business: Executive Q&A Notes

Building and selling online courses may seem easy, but building a profitable learning-based business is far more complex. Find out what successful leaders say about running this kind of business

The Rewards of Community Building: Customer Ed Nugget 14

What role does community play in your customer relationships? Find out why community building is such a powerful force in customer education on this Customer Ed Nuggets episode

Benefits of Training Content Syndication: Customer Ed Nugget 13

If you educate customers online, why should you consider content syndication? Discover 10 compelling business benefits in this Customer Ed Nuggets episode

Top Marketing Skills to Master: Customer Ed Nugget 12

Successful customer education programs depend on professionals with expertise in multiple disciplines. Which marketing skills lead to the best results?

How to Measure and Improve Partner Training ROI

An educated channel is a successful channel. But how do you know if your educational programs are effective? Learn from an expert how to evaluate partner training ROI

Mistakes in Ongoing Customer Training: Customer Ed Nugget 11

Customer education doesn't stop with onboarding. It pays to invest in ongoing customer training. Learn which mistakes to avoid in this Customer Ed Nuggets episode

FOLLOW US ON SOCIAL